Creating An Earning Pay Head

To create an Earning Pay Head, Basic Salary, under Indirect Expenses:

Earning For Employee

Basic

Bonus

DA

HRA

Over Time

Reimbursements

TA

Deduction From Employee

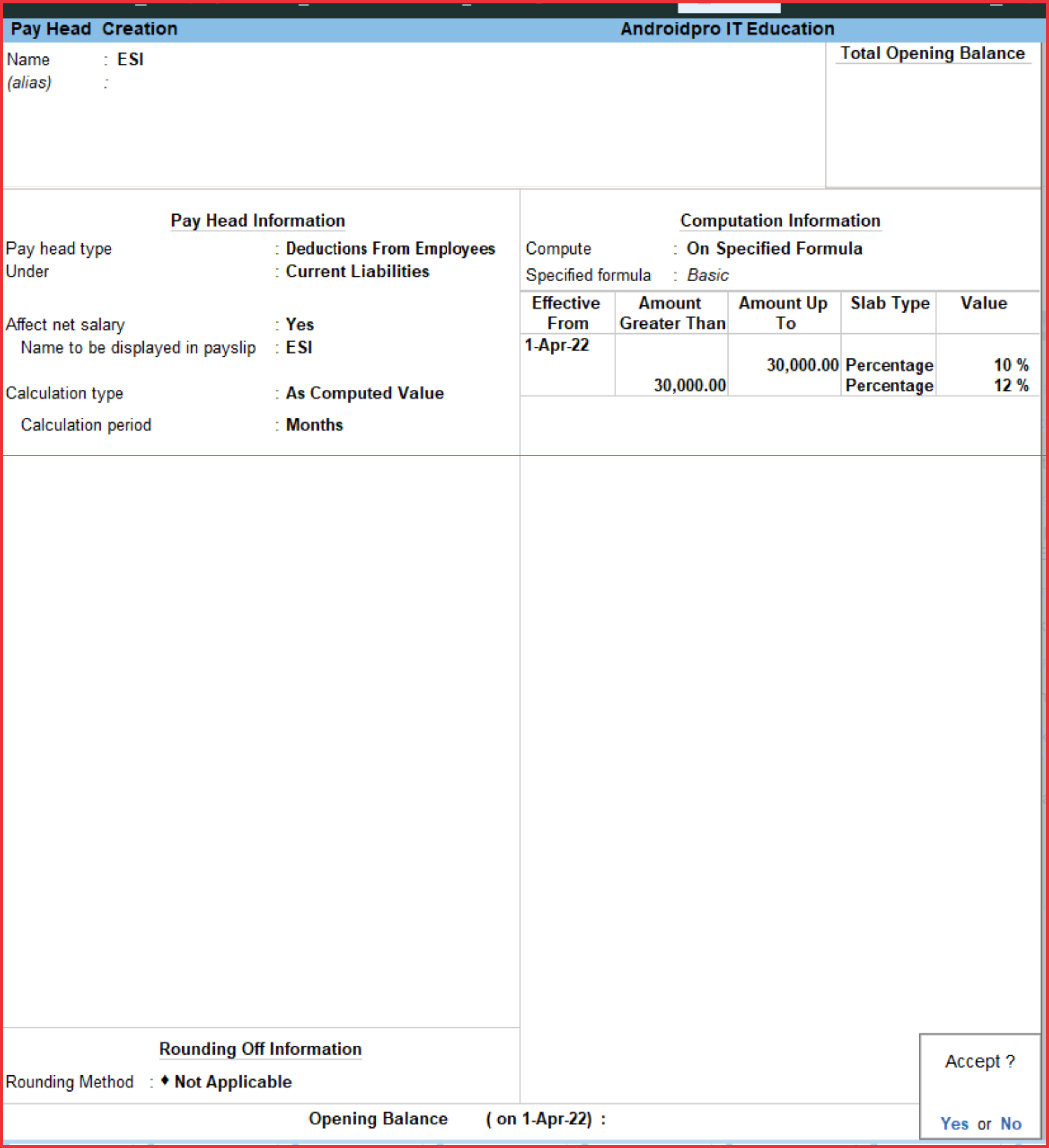

ESI

Leave

PF

1 PAY HEADS CREATION BASIC

1. Enter the Name of the Earning Pay Head.

2. Select Earning for Employees as the Pay Head Type form the List of Pay Head Types.

3. Select the respective Pay Head Group Earnings from the list for the field Under.

4. select Yes from the list if you want the Pay head to affect the net salary.

5. The Pay Head name entered in the Name field will appear in this field. You can change the same, if required. The name entered in this field will appear on the payslip.

6. Select Flat Rate from the List of Calculation Types.

7. Select the Calculation Period Type from the list. 290

8. Based on the Calculation Period Type, you can select and enter the details for Per Day Calculation Basis.

9. Select the Rounding Method from the list if applicable.

10.Accept to save the Pay Head.

Similarly, you can crate Earning Pay Heads for HRA, Conveyance and so on…

2 Pay Head Creation Bonus

3 Pay Head Creation DA

4 Pay Head Creation HRA

5 Pay Head Creation Over Time

6 Pay Head Creation REIMBURSEMENTS

7 Pay Head Creation TA

Creating A Deduction Pay Head

To create a Deduction Pay Head, Professional Tax under Employees’ Statutory Deductions:

1. Enter the Name of the Deduction Pay Head.

2. Select the Pay Head Type from the List of Pay Head Types.

3. Select the Group from the List of Groups.

4. select Yes from the list if you want the Pay Head to affect the net salary.

5. The Pay Head name entered in the Name field will appear in this field. You can change the same, if required. The name entered in this field will appear on the payslip. 291

6. Select the Calculation Type from the List of Calculation.

7. On selecting the Calculation type to ‘As Computed Value, a new field Calculation Period appears which will be set to Months automatically.

8. Select On Current Earnings Total from the list to be Computed On.

9. Specify the Slab Rate.

10. Select the Rounding Method from the list if applicable.

11.Accept to save the Pay Head.

Similarly, you can create a Deduction Pay Head for Provident Fund and so on

Note: If you are using any Pay Head component having Calculation Type As Computed Value and Compute: On Current Earning Total, while defining Salary Detail, the sequence of the component has to be selected accordingly.